“Do not save what is left after spending, but spend what is left after saving”. Warren Buffet

“Do not save what is left after spending, but spend what is left after saving”. Warren Buffet

This statement is sufficient enough to explain the difference between a literate and financial literate person. The term “financial literacy” refers to a variety of important financial skills and concepts. Financial literacy is the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing. Unfortunately, literacy and financial literacy are misunderstood to be synonymous.People who are financially literate are generally less vulnerable to financial fraud.

The role of FL has increased due to increasing inflation rate, war like situations, jobs crisischallenges posed by technology in the business. Etc. A strong foundation of financial literacy can help support various life goals, such as saving for education or retirement, using debt responsibly, and running a business.

Key aspects to financial literacy include knowing how to create a budget, plan for retirement, manage debt, and track personal spending.

Key Components of Financial Literacy–

- Planning : Planning include our expectation form life in future.

So one should plan its savings as well as its expenditure. Planning is an integral indicator of how sustainable your accounting quotient is. As long as you can sustain enough with your income excluding planned savings, the savings should remain untouched.

- Savings : Never spend your money before you have it

Saving means putting aside certain amount of your income. A literate person may spend first and save the residual in any, while a FL person will save first and spend the left over. A little pain of today may be a big relief in future. Hence a reasonable part of the income should be saved and the left over should be spent.

Literate Person : Income – Expenditure = Savings

Financial Literacy : Income – Savings = Expenditure

- Investment : Savings bear no fruit unless they are invested.

The next face of financial literacy is Investment. It includes how judiciously you construct your expenditure and saving model. In the hierarchy of the important postulates of Saving- Where you save your money?Choosing the right place of investing and keeping your money safe while simultaneously making some money through interest rates go a long way.

Compound Savings : The knight in shining armour

Compound Savings : The knight in shining armour

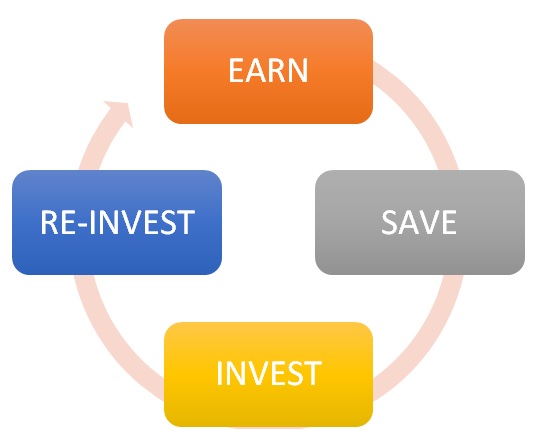

Vicious Cycles are often heard as negative cycles to be warned of! But, for a change, investment is that vicious cycle you should try getting yourself trapped in. The basic concept behind this is-

A Four step guide

Way forward:Financial skills will help to raise the standard of living and contribute to overall growth. In short, a financially smart India would be a major force in the world.

NIVEDITA SHUKLA

NEHA DIXIT

(Commerce Department)